Banner Image Courtesy of Materialise

Additive manufacturing (AM), commonly known as 3D printing, is redefining production paradigms across industries—and nowhere is its impact more pronounced than in aerospace. Traditional aerospace supply chains, with their complex webs of suppliers, long lead times, and high inventory costs, are ripe for disruption. By enabling on-demand manufacturing, part consolidation, and distributed production closer to end-use locations, 3D printing slashes overhead, reduces risk, and accelerates innovation.

Understanding Traditional Aerospace Supply Chains

Aerospace manufacturing relies on a multi-tiered supplier network that sources raw materials, sub-assemblies, tooling, and finished parts across continents. This structure emerged to achieve economies of scale for high-precision components—but it comes with significant trade-offs:

Extended Lead Times

Producing injection-molded tooling, machined jigs, or cast alloy parts often involves weeks or months of design, validation, and shipping. Critical spares can remain in transit for 4–6 months, forcing operators to carry large safety stocks.

High Inventory Carrying Costs

Minimum order quantities (MOQs) established by suppliers drive up part counts, even for low-demand or legacy applications. For slow-moving spares, companies end up with warehouses full of obsolete parts.

Risk of Disruption

Geopolitical tensions, trade tariffs, natural disasters, and logistical bottlenecks can immediately halt production or delay deliveries. During the COVID-19 pandemic, some aircraft programs experienced six-month supply interruptions when single-source suppliers went offline.

Complex Quality Control

Every hand-off between tiers introduces potential for miscommunication, variation in process control, and additional non-destructive testing (NDT) requirements—adding cost and inspection time.

These factors combine to inflate both direct piece costs and the “hidden” costs of capital tied up in inventory, idle tooling, and audit trails. As aerospace OEMs and Tier-1 suppliers seek greater agility and resilience, alternative approaches to sourcing and production become imperative.

Key Benefits of 3D Printing in Supply-Chain Management

3D printing dismantles many of these traditional pain points by altering how, where, and when parts are manufactured:

1. On-Demand Production

Zero Minimum Orders: Digital part files can be printed in batches as small as one, eliminating bulky MOQs and reducing inventory. Operators maintain a “digital warehouse” of validated designs, printing spares only when needed.

Reduced Warehousing: With parts produced on demand—either at centralized AM hubs or distributed micro-factories near airports—companies drastically shrink physical storage footprints and lower carrying costs.

2. Part Consolidation

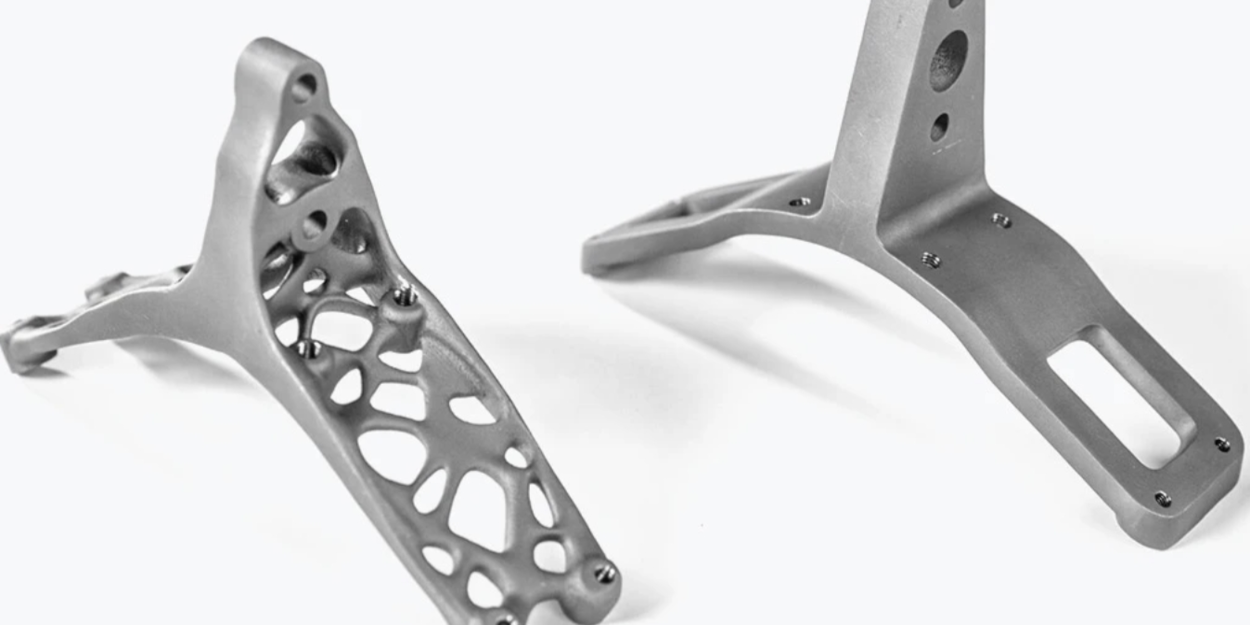

Assembly Reduction: Complex assemblies comprising dozens of fasteners and sub-components can often be consolidated into a single printed geometry. This minimizes assembly time, reduces potential leak paths or failure points, and simplifies bill-of-materials management.

Weight Savings: Optimized lattice structures and topology-optimized designs reduce material usage—translating directly into fuel savings for aircraft and satellites.

3. Decentralized, Near-Point-Of-Use Manufacturing

Localized Hubs: AM service bureaus and on-site micro-factories at maintenance bases enable rapid printing of replacement parts, cutting out days or weeks of shipping.

Reduced Transport Risk: Less cross-border logistics means lower exposure to customs delays, port strikes, and cargo losses.

4. Rapid Iteration & Lead-Time Reduction

Faster Design Tweaks: Engineers can update digital models instantly to address fit or performance issues and then print revised parts in hours rather than waiting for new tooling.

Accelerated Certification: Standardized AM process chains—with machine parameters locked in—mean that part requalification can leverage prior data, speeding regulatory approval.

Material & Process Innovations for Aerospace Applications

High-Performance Metal Alloys

Selective Laser Melting (SLM) and Electron Beam Melting (EBM) systems can now print flight-grade Ti6Al4V, Inconel 718, and aluminum AlSi10Mg. These alloys meet stringent fatigue, tensile, and fracture toughness requirements—and, when printed with tight process control, deliver mechanical properties on par with wrought materials.

Certified Polymer Composites

Ultem®, PEEK, and carbon-fiber-reinforced nylon are used for interior components, brackets, and non-structural ducting. Their high thermal stability and flame-retardant properties comply with FAR 25 regulations for cabin safety.

Hybrid Workflows

AM isn’t just for end parts. 3D printed tooling, jigs, and fixtures accelerate CNC machining setups by producing custom work holding in days. This hybrid approach slashes lead times for low-volume parts without sacrificing precision.

Equipment manufacturers are embedding in-situ monitoring—melt-pool imaging, thermography, and powder-coater sensors—to ensure each layer meets tight tolerances. This real-time data not only enables confidence in part quality but also reduces the amount of post-build inspection required, further streamlining the supply chain.

Overcoming Challenges & Mitigating Risks

Qualification & Certification

Regulatory Pathways: Both the FAA and EASA have established frameworks for approving 3D-printed parts, but they require extensive process documentation, material characterization, and batch traceability.

Data Management: Digital thread solutions must secure part files, record parameter changes, and integrate with enterprise quality-management systems (QMS).

Quality Assurance & Testing

Non-Destructive Testing (NDT): Methods like CT scanning, ultrasonic inspection, and dye-penetrant tests remain critical for flight-critical parts. Streamlining inspection protocols around AM’s layerwise manufacturing is an active area of development.

Process Control: Statistical process control (SPC) and machine health monitoring guard against variation in powder quality, laser power drift, or recoater blade wear.

Supply-Chain Security & IP Protection

Cybersecurity: Protecting digital part inventories from unauthorized access or tampering is paramount. Encrypted file transfer, blockchain-enabled traceability, and secure access controls help safeguard proprietary aircraft designs.

Vendor Management: When distributing digital files to service bureaus, OEMs must vet partners for data-security compliance and disaster-recovery capabilities.

Economic Considerations

CapEx vs. OpEx: Heavy investments in high-end metal printers can be daunting; many companies opt for contracted AM-as-a-service models to avoid upfront capital expenditure.

Total Cost of Ownership: A holistic view factors in reduced warehousing, fewer scrapped parts, and lower shipping expenses—often revealing a favorable ROI within 12–18 months for targeted programs.

The Future of Aerospace Supply Chains with 3D Printing

1. Machine-Learning-Driven Process Optimization: AI algorithms will monitor AM machines in real-time, adjusting laser power and scan paths to mitigate defects before they occur—unlocking even tighter tolerances and higher throughput.

2. Mass Customization & Adaptive Parts: Data-driven design will enable parts that adapt to in-service conditions—self-healing brackets, topology-optimized heat exchangers tailored to specific flight profiles, and sensor-embedded structural components.

3. Predictive Maintenance & Digital Twins: By coupling digital part inventories with operational data, airlines will trigger automated print orders for wear-prone parts as soon as performance thresholds are reached—eliminating unplanned AOG (Aircraft on Ground) events.

4. Global Digital Supply Networks: Rather than shipping physical parts, airframers will route encrypted digital blueprints to the nearest certified AM hub, producing parts on demand while maintaining full visibility and traceability across the network.

Visionaries predict that by 2030, over 25% of all flight-critical components on new aircraft will be additively manufactured, with digital warehousing and localized micro-factories replacing traditional distribution centers. This paradigm shift will yield unprecedented resilience to market fluctuations, geopolitical tensions, and the evolving demands of commercial, defense, and space applications.